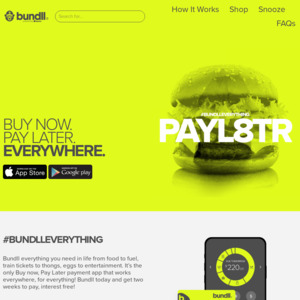

A fuzzy welcome to the new payment app bundll. Apply for bundll and be approved before 30 November 2021 and we’ll give you 10 bucks back^!

bundll lets you buy everything, everywhere* and repay later, interest free^^.

Bundll is Buy Now, Pay Later, Everywhere. And we mean everywhere! Whether you’re shopping online, in the app or cruising your local mall, #tapthebear and get 2 weeks to repay.

^Offer valid for new bundll customers only. Valid for applications approved between 18 October – 30 November 2021, unless allocated prior. First 1,000 new approved customers only.

Apply the code to get a free snooze (to extend extra 14 days to pay).

Probably better to wait for a better discount such as $20-$50 like the others