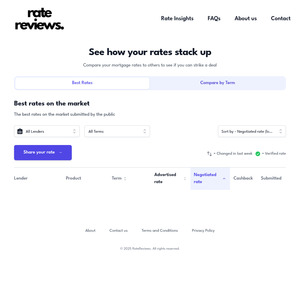

My friends and I made this community driven website called RateReviews.co.nz to compare what banks are actually offering for mortgages instead of relying on the advertised rates or what people have been posting on facebook or whatever - all free

Here’s how it works - people post what rate they're getting (either through their banking app or through mortgage broker) and it gets updated on the website. If someone posts a lower "negotiated" rate, then that gets updated. Obviously you pick which bank and what term you have etc etc.

People who upload rates can upload verification proof (optional). Everytime a rate comes through that has verification, we verify it on our dashboard in the backend and will show a tick next to the negotiated rate if verified. There are some protections in place (someone cant post a 0% interest rate for example)

That’s it really, over time, the site will show what rates are really out there so everyone can get a better deal. We have had such good traction and feedback from the community - would be great to know what Cheapies memebers think!

If you’ve got a mortgage rate to share or just wanna check it out, give it a go! Let me know what you think, its been live a week or two now, so would be keen to know your thoughts

Cheers

Kyle from RateReviews

The very first one that comes up for SBS First Home Combo shows an advertised 1 year rate of 4.79% and a negotiated rate of 4.89%.

I presume that's an error (or really bad negotiating skills!)