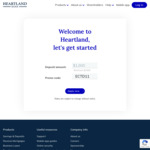

Received the exclusive offer via email - could be targeted to certain Heartland customers only, but the promo code looks generic. Minimum deposit $1,000.

As a thanks for being a valued Heartland customer, we've given you access to special rates on our 7-month and 11-month Term Deposits. But be quick - this offer is ending soon on 28 April 2023.

To apply, use the link below or through your Heartland app:

7 Months 5.70%: https://www.heartland.co.nz/special-offer?promo=ECTD7

11 Months 6.10%: https://www.heartland.co.nz/special-offer?promo=ECTD11

Fine Prints: Minimum deposit of $1,000, maximum deposit of $5,000,000. Offer is exclusive to Heartland customers and is valid between 3 - 28 April 2023.

Comparison:

https://www.interest.co.nz/saving/term-deposits-1-to-9-month…